- #QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME HOW TO#

- #QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME UPDATE#

- #QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME FREE#

#QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME UPDATE#

Make sure to update QuickBooks Desktop application and download the latest tax table before proceeding with the troubleshooting.QuickBooks continues to calculate the tax amount even after the year-end.The total tax amount appearing on paychecks is $0.

#QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME HOW TO#

In this article, we will put our focus on how to fix payroll mistakes in QuickBooks. There might be several reasons before getting an incorrect wage or payroll tax amount.

#QUICKBOOKS DESKTOP PAYROLL EMPLOYEE NON WAGE INCOME FREE#

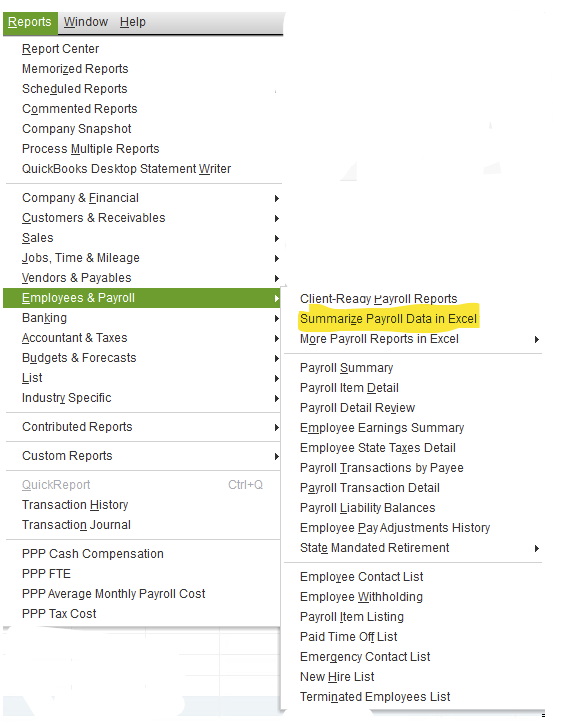

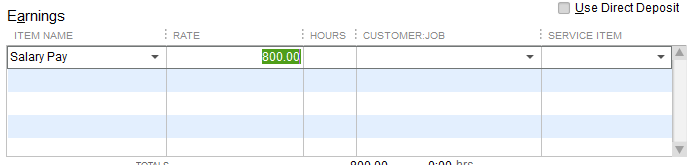

A user’s responsibility includes keeping QuickBooks Desktop application and tax table up to date and input correct employee’s info in QuickBooks for error free tax calculation. Save my name, email, and website in this browser for the next time I comment.With an active subscription of QuickBooks Desktop Payroll, you can leave the complex task of wages and payroll tax calculations to QuickBooks as it can automatically calculate all the taxes for you by fetching employee’s data from the Desktop app. Your email address will not be published. In case you still need further information on how to pay a bonus on separate paychecks in QuickBooks at any point, you can reach at our QuickBooks helpdesk team and talk at LIVE CHAT, will help you anytime 24 x 7. Hopefully, you must have clarity now on the setting up of the bonus payroll item, adding the bonus as pay type in the employee’s profile, and adding bonus to the paycheck. Step 3.Finally, click on create and approve the payroll item. Step 2.In the next step, enter the amount that you want to pay as a bonus in the Bonus field. Step 1.First of all, click on the Payday tab > select the employee. Step 3 At last, click on Show all pay types> Bonus> then OK. Now in the Pay section under after clicking on the employee’s name click on Edit. Step 1 At the start click on the Employees tab and select the employee’s name whom you want to pay the bonus for the first time. Know how to give or record an employee a bonus in QuickBooks, You can follow the below steps to do the same: If you are paying a bonus to a specific employee for the first time you will have to add bonus as pay type in his / her profile on the QuickBooks. For adding the Bonus as pay type in employee’s profile Now enter the name of the item and move forward by clicking on next and then select the specific expense account that you want the item to be linked with and click on Finish. Step 4.In step 4, you need to click on wage> then next> Bonus> and then Next again. After step 2, you need to click on custom setup > then next. Step 2.Now in the next step, you need to search and click on the payroll item button at the lower side left of the payroll item list. After that, you need to click on the list and then payroll item list. At the initial step, you need to open QuickBooks on your computer and click on the Desktop menu at the top.

Read: How to submit Payroll in QuickBooks Desktop? Setting up of bonus payroll item in QuickBooks DesktopĪs discussed above, for setting up of bonus payroll item in the QuickBooks on your computer, or add bonus to payroll in QuickBooks desktop you will have to follow the below steps: The below stepwise step writeup will guide you in setting up the bonus payroll item in the QuickBooks. If you want to pay a bonus to the employee in QuickBooks for the first time, you will have to set up the bonus payroll item in the QuickBooks and also add bonus pay in the type section to the employee’s profile on the QuickBooks. The bonus is mostly performance-linked or given on the completion of a certain project and given as a token of appreciation to the employees by the employer. over and above the monthly salary or wages. User Query: I am a new at QuickBooks and want to know how to pay a bonus on regular paychecks in QuickBooks Desktop & how to record a cash bonus?īonus is a variable component of the employees’ annual package i.e.

0 kommentar(er)

0 kommentar(er)